Well of course that’s true, but it’s not always the best strategy. People will ask, and pay, for a valuation on a business. I’ll do the research and run the numbers. Ultimately, I’ll come up with my opinion as to the most probable sales price. In this case let’s say $500,000.

Then I’ll get asked, “What should I list it for: $550,000, $575,000, maybe $595,000?” I understand the thinking. No one wants to leave money on the table. There is a chance someone will pay the premium. Occasionally, or as they say, ‘once in a blue moon’, that can happen, but more often than not the reverse is true.

Let’s see how this often plays out. The business is placed on the market, say at $575,000. There is some initial activity because it’s new to the market, but no offers. Then there is a period of no interest. To generate new activity, the decision is made to reduce the price (Reducing the price by much less than 10% isn’t usually significant enough to create much difference). The seller, being optimistic, decides to reduce it $25,000 to $550,000, which still remains at $50,000 above market. The seller and broker have a new sense of optimism and yet little or nothing happens.

Ok, third time is the charm, right? So the seller says, “We tried. Let’s sell it for $500,000 and move on”. The price is reduced to $500,000, the showings are up and finally an offer comes in at $460,000. The buyer has indicated this is their best and final offer; after all it’s been on the market for 9 months. The parties agree to a $475,000 selling price.

Let’s look at it another way. It’s initially listed for $500,000 to $525,000. There is again initial interest, yet this time there is genuine interest and an offer comes in at full price and there are other buyers also expressing interest. Compared to all the other overpriced businesses, this newly listed business looks like a good deal. The strongest offer in terms of price and conditions is accepted. Compare the two strategies. The listing it at the right price yielded $25,000 to $50,000 more. Sure this is just an example but we see it all the time.

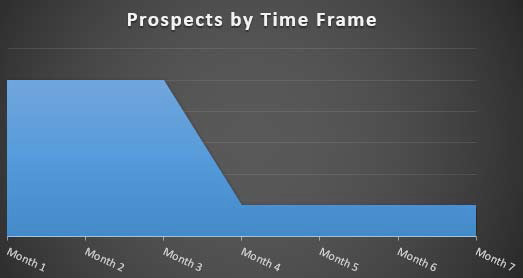

So why is this so? Looking at the graph below explains it well.

The strategy is based on the concept that at any moment there are a certain number of people in the market and that a few enter and leave on a regular basis over time. The critical strategy is to have it sold in the initial period, before it becomes “show worn”.

Show worn is when people say it’s been on the market for a long time so their offer must be reasonable. They don’t care that the price has been dropped a few times, it’s still been on the market for a long time; they think the seller should be glad to have an offer, and they certainly are not going to over pay.

Bottom line: properly priced businesses, are SOLD businesses.

Call our team at Magnusson Balfour today at 207-774-7715.